Get the free regular pay is the compensation you earn multiplied by the number of hours worked

Show details

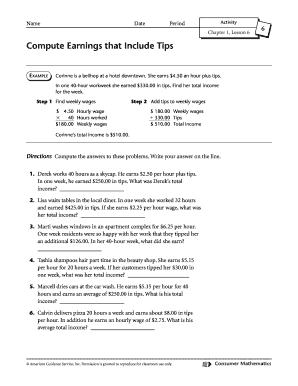

Name: Date: Calculating Your Paycheck Hourly and Overtime Pay Version 1 Some employers pay a set amount for every hour an employee works. This is called regular pay. An employee may also earn overtime

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign calculating your paycheck salary worksheet 1 answer key form

Edit your how to calculate my paycheck form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to calculate your paycheck form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to calculate paycheck online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 1500x52 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out calculating your paycheck salary worksheet 1 form

01

To fill out calculating your paycheck salary, start by gathering all necessary information, including your gross income, deductions, and any additional earnings or benefits.

02

Next, determine your gross income, which is the total amount you earn before any deductions are taken out. This may include your hourly wage, salary, or commission.

03

Subtract any pre-tax deductions from your gross income. Pre-tax deductions can include contributions to retirement plans, health insurance premiums, and flexible spending accounts. These deductions reduce the amount of taxable income.

04

Once you have calculated your taxable income, apply the appropriate tax rates and deductions to determine your federal, state, and local income tax liability. This can typically be done using tax tables or online calculators provided by your government.

05

After calculating your income tax, subtract any additional deductions or exemptions to arrive at your net income. These deductions may include student loan interest, alimony, or contributions to charitable organizations.

06

Finally, consider any additional earnings or benefits that may affect your paycheck calculation, such as overtime pay, bonuses, or stock options. These should be added to your net income.

07

It is important to note that everyone who receives a paycheck needs to calculate their salary. This includes employees, freelancers, and self-employed individuals who are responsible for calculating their own earnings and taxes.

08

Additionally, employers and payroll departments also need to calculate paychecks for their employees to ensure accurate and timely payment.

09

Accurately calculating your paycheck salary is essential for budgeting, managing your finances, and ensuring proper tax withholdings. It helps to understand the components that make up your paycheck and how different factors contribute to your overall salary.

Fill

how to calculate your pay

: Try Risk Free

People Also Ask about 32 an hour salary

What is overtime pay calculated as?

For non-exempt employees, overtime pay can typically be calculated by multiplying your regular pay rate per hour by the time-and-a-half rule (1.5). You would then multiply this result by the number of overtime hours worked within a specific pay period.

How do you calculate overtime and regular pay?

Following FLSA rules, multiply the regular rate of pay by 1.5 and multiply the result by the total number of overtime hours worked.How to calculate overtime pay for hourly employees $10 x 40 hours = $400 base pay. $10 x 1.5 = $15 overtime rate of pay. $15 x 6 overtime hours = $90 overtime pay. $400 + $90 = $490 total pay.

How do you calculate 1.5 times?

Hourly employee example Let's say that your company has a nonexempt hourly employee named Jane who makes $15 per hour. $22.50 = $15 x 1.5. Jane's time and a half pay rate is therefore $22.50 per overtime hour. $225 = $22.50 x 10 hours.

How do you calculate paycheck and overtime pay version 1?

Overtime pay is calculated: Hourly pay rate x 1.5 x overtime hours worked. Here is an example of total pay for an employee who worked 42 hours in a workweek: Regular pay rate x 40 hours = Regular pay, plus. Regular pay rate x 1.5 x 2 hours = Overtime pay, equals.

How to calculate salary?

To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1,500 per week, the individual's annual income would be 1,500 x 52 = $78,000.

How do you calculate time and a half?

How to calculate time and a half pay First, you need to get the total regular wages for the week. To get the hourly time and a half rate, multiply the regular hourly wage by 1.5. Multiply the hourly overtime pay by the number of overtime hours rendered. Add both regular and overtime wages.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the how to figure out your paycheck electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your how to calculate salary be 1 in seconds.

How can I edit how to work out hourly rate from salary on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 30 an hour salary, you need to install and log in to the app.

How do I fill out computing wages worksheet answer key using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign calculating gross and weekly wages worksheet answers key and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is calculating your paycheck salary?

Calculating your paycheck salary involves determining the total earnings of an employee for a specific pay period, taking into account hours worked, wage rates, overtime, deductions, and taxes.

Who is required to file calculating your paycheck salary?

Employers are required to file the calculated paycheck salary for their employees to report earnings, withholdings, and ensure compliance with tax regulations.

How to fill out calculating your paycheck salary?

To fill out the calculation for your paycheck salary, you need to gather data on hours worked, wages, overtime, any deductions (like taxes or benefits), and then apply the appropriate formulas to arrive at the net pay.

What is the purpose of calculating your paycheck salary?

The purpose of calculating your paycheck salary is to ensure that employees are compensated accurately for their work, to comply with labor laws, and to provide clear documentation of earnings and withholdings.

What information must be reported on calculating your paycheck salary?

The information that must be reported includes employee name, hours worked, wage rate, gross pay, deductions (like taxes, insurance, retirement contributions), and the net pay after deductions.

Fill out your regular pay is form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How Calculate Your Paycheck is not the form you're looking for?Search for another form here.

Keywords relevant to how to figure out my paycheck

Related to how do you calculate your paycheck

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.